Foreign Buyers Return to U.S. Housing Market, Reigniting Debate Over Ownership and Access

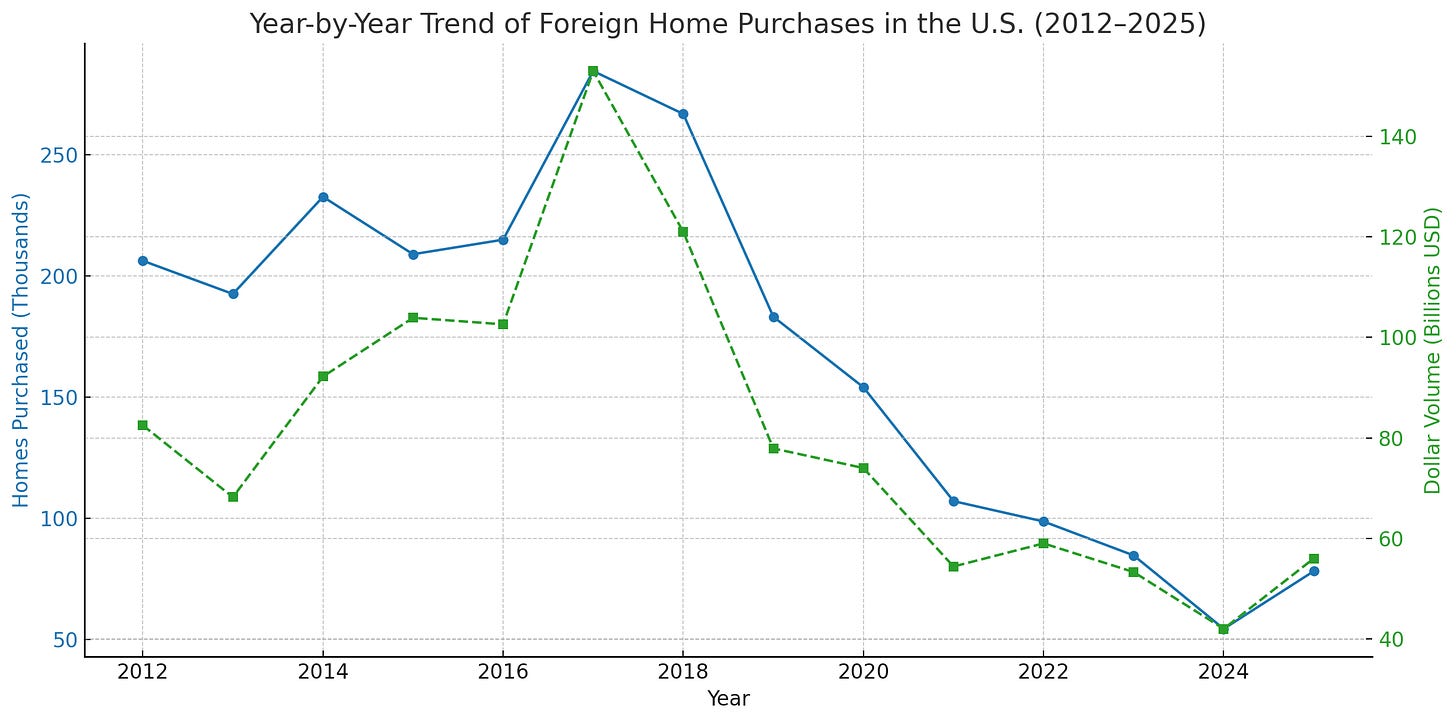

Foreign buyers purchased an estimated 78,100 homes in the United States between April 2024 and March 2025. That marks a 44% jump in volume from the previous year.

Holly Springs, NC, Jul. 20, 2025 — After several years of decline, foreign investment in U.S. residential real estate is surging again, fueling a fresh round of economic activity, political scrutiny, and local unease.

According to the National Association of REALTORS®’ latest annual report, foreign buyers purchased an estimated 78,100 homes in the United States between April 2024 and March 2025. That marks a 44% jump in volume from the previous year and the first significant rebound since 2017. In total, international buyers spent $56 billion on U.S. existing homes, representing 2.5% of total home sales by dollar value.

This influx, led by buyers from China, Canada, Mexico, India, and the United Kingdom, is renewing familiar tensions over who has the right to own a piece of the American dream.

Cash Offers, High Prices, Limited Inventory

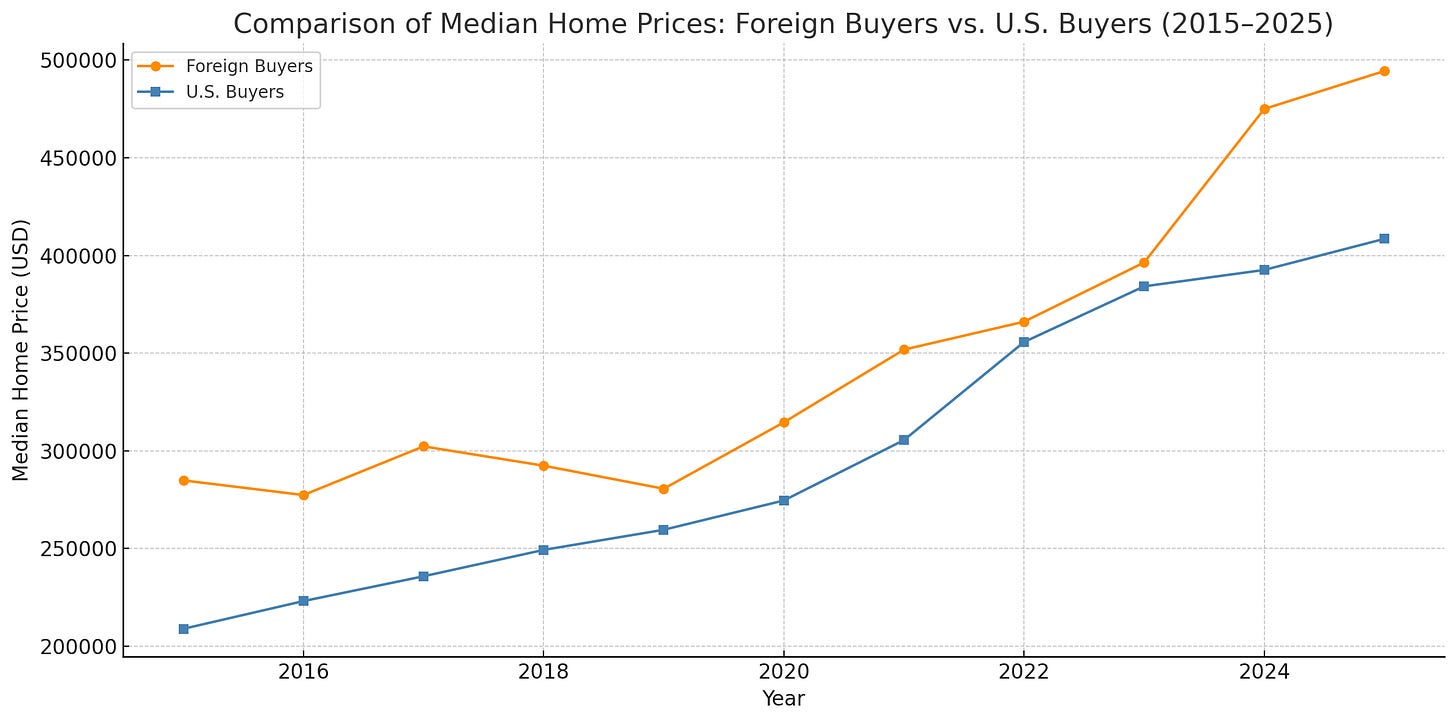

Foreign buyers, who often arrive with substantial capital, are purchasing U.S. homes at a pace and price point that increasingly distinguishes them from domestic buyers.

The median foreign buyer paid $494,400, well above the national median of $408,500. Nearly half of these buyers paid in all-cash, further complicating access for local buyers relying on financing in a market still grappling with tight inventory and stubborn interest rates.

Notably, 47% of international buyers purchased properties for vacation, rental, or investment use—three times the rate among U.S. homebuyers.

Florida remained the top destination for foreign investors (21% of purchases), followed by California (15%), Texas (10%), New York (7%), and Arizona (5%).

North Carolina did not make the top five list in 2025. Still, it has consistently drawn interest, accounting for roughly 4% of foreign buyer activity in the previous year, particularly from Canadian and Latin American buyers.

Top 10 U.S. States by Share of Foreign Homebuyers (2025)

(Source: National Association of REALTORS®)

Florida – 21%

California – 15%

Texas – 10%

New York – 7%

Arizona – 5%

Hawaii – 3%

North Carolina – 3%

Michigan – 3%

New Jersey – 3%

Illinois – 3%

A Political Flashpoint

The revival of foreign homebuying has reignited a political debate that touches on housing affordability, national security, and economic nationalism. In July, U.S. Senator Josh Hawley (R-MO) introduced Senate Bill 2258, which would prohibit certain foreign entities from purchasing agricultural or residential property in the U.S. Though the bill’s full text has yet to be released, its intent echoes a broader trend in Congress.

Multiple bills introduced in recent years aim to restrict, tax, or monitor foreign real estate purchases:

H.R. 6383 (2022): Would impose a five-year nationwide moratorium on all foreign land acquisitions.

S. 926 (2023): Seeks to block land purchases by entities tied to China, Russia, Iran, or North Korea.

Real Estate Reciprocity Act (2025): Would levy a 50% surtax on residential real estate purchases by nationals from countries that restrict American ownership abroad.

While none of these measures have passed into law, momentum is building. State legislatures have introduced over 40 similar bills in 2025 alone, with 13 currently under active consideration.

Global Tightening, Local Impacts

If the U.S. moves toward restrictions, it wouldn’t be alone. Around the world, governments are increasingly drawing boundaries around who can buy and where.

Canada extended its ban on non-resident home purchases through 2027, citing inflation and supply shortages. Spain is weighing a 100% tax on non-EU buyers and potential bans on British second-home ownership. In Australia, public pressure has led to calls for curbing Chinese property purchases.

Mexico, by contrast, allows foreign homeownership, though not without controls. In sensitive “restricted zones” near coastlines and borders, foreigners must purchase through a “fideicomiso”, a 50-year bank trust arrangement. Mexico City, facing a surge of digital nomads and rising rents, is considering rent caps and restrictions on short-term rentals.

A Divided Outlook

Advocates of open real estate markets argue that foreign capital fuels local economies, funds construction, and generates employment opportunities. Opponents counter that it inflates prices, displaces residents, and hands over control of critical assets.

North Carolina finds itself in the middle of this debate. Its steady population growth, attractive climate, and relatively affordable home prices have made it a popular destination, not just for Americans relocating from other states, but for global investors seeking long-term value.

The question now confronting policymakers, both locally and nationally, is how to balance openness with protection, opportunity with fairness.

There’s no doubt that foreign interest in U.S. real estate is strong again. The challenge is ensuring that Americans aren’t priced out of their communities as a result.

The Bottom Line

The U.S. housing market is once again a magnet for foreign capital, especially in high-value and high-demand markets. While the benefits are tangible, so too are the risks. As Congress considers legislation and other nations close their doors, the future of foreign homeownership in the United States hangs in the balance.