Wake County (NC) Faces Slower Tax Growth as Appeals and Exemptions Cut Into Revenue

Officials say the shortfall is driven largely by appeals today, but warn that exemptions and market shifts could shape future budgets, projects, and tax decisions for residents.

Raleigh, NC, Feb. 18, 2026 — Wake County officials are confronting a growing financial challenge that could influence future budgets, capital plans, and possibly even tax rates: the county’s property-tax base is not growing as quickly as expected.

During Monday’s Wake County Board of Commissioners meeting, county staff reported that taxable property value is coming in roughly $1.5 billion below projections, translating to about $20 million less in property-tax revenue than anticipated for the current fiscal year.

The gap is not tied to declining home values or a sudden slowdown in the local economy. Instead, officials pointed to a combination of appeals, legal tax exemptions, and broader structural pressures on the tax system.

Appeals drive the current shortfall

County staff said the immediate revenue gap is being driven primarily by property-tax appeals filed after the county’s 2024 revaluation.

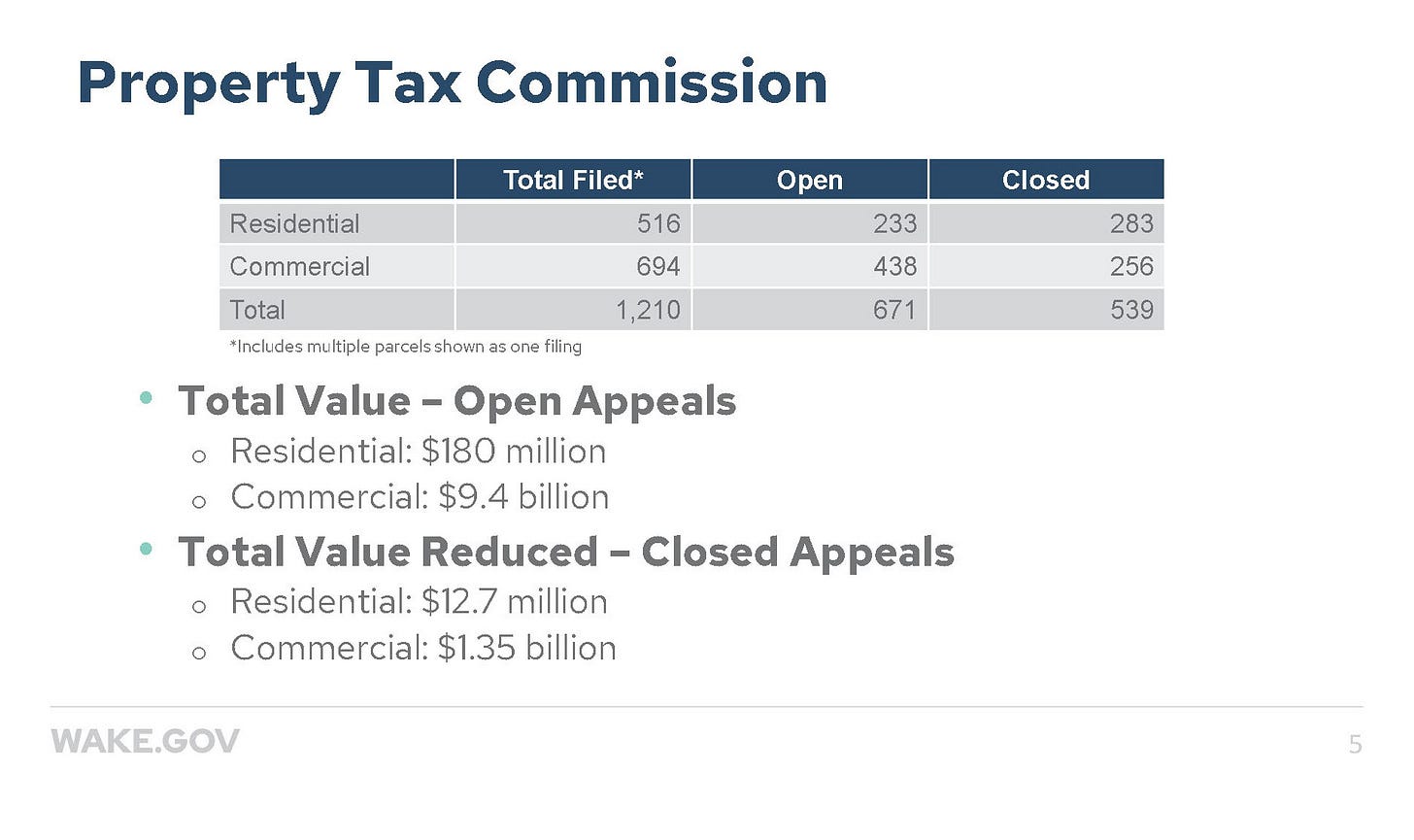

More than 1,500 appeals were filed with the North Carolina Property Tax Commission, an unusually high number, and many involve large commercial properties. Issued decisions have reduced assessed values by more than $1 billion, with hundreds of cases still pending.

Commercial property appeals often succeed when market conditions change, since valuations are tied to income, occupancy, and financing costs. Officials noted that the recent wave of appeals reflects broader shifts in commercial real estate rather than a sudden local downturn.

Because commercial properties represent a large share of the tax base, even a handful of successful appeals can significantly reduce projected revenue.

Exemptions raise longer-term concerns

While appeals explain much of the current-year shortfall, officials warned that tax exemptions could pose a larger structural challenge over time.

Two types of exemptions are affecting Wake County’s tax base.

The first involves brownfield redevelopment, where state law temporarily excludes most of a property’s new value from taxation to encourage investment in previously contaminated or underused sites.

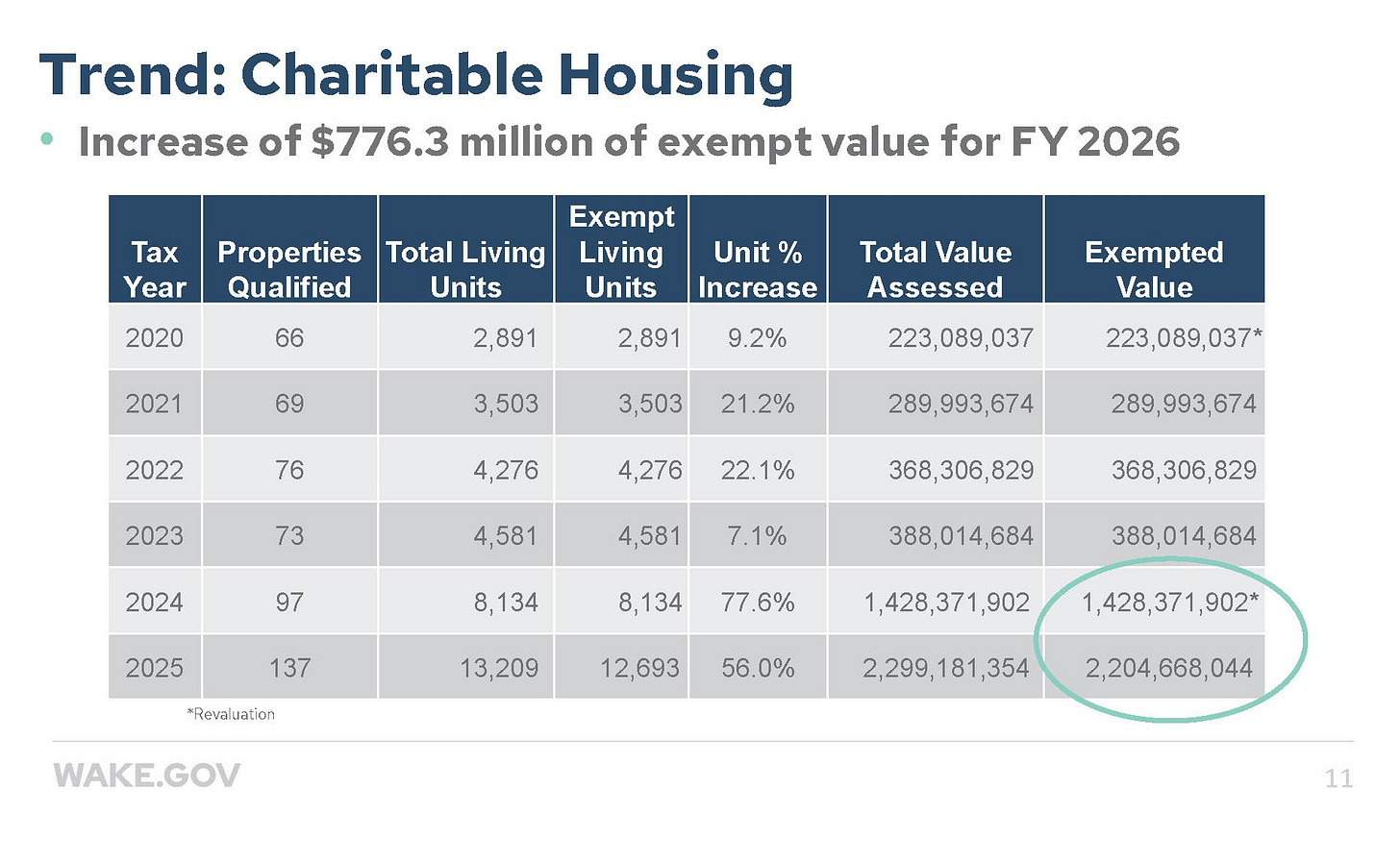

The second, and more consequential, involves nonprofit housing exemptions.

Under state law and court interpretation, a multifamily property may qualify for tax exemption if it is owned in part by a nonprofit entity and rents fall below certain income thresholds. County officials said that, in practice, some apartment complexes that have paid taxes for decades may qualify after a change in ownership, even if they were not originally built as subsidized affordable housing.

Staff reported that about $776 million in property value was removed from the tax base in one year, with additional applications pending that could remove more.

Officials emphasized that the exemptions are legal under current state law and cannot be changed by the county alone.

A growing fiscal pressure point

While Wake County remains financially strong, with property values high and tax collection rates near 100 percent, the slower growth in the tax base could influence future spending decisions.

Staff had expected roughly $35 million in new property-tax revenue next year based on growth. Because of appeals and exemptions, that increase may be much smaller.

If revenue growth slows while demand for services continues to rise, commissioners may face tougher choices about spending priorities, project timelines, or tax rates in future years.

What it could mean for residents

For most residents, the issue won’t show up as an immediate change in tax bills. But slower growth in the tax base can ripple outward over time.

If new revenue grows more slowly than expected, the county may face tougher choices about how quickly to fund schools, infrastructure, and public-safety projects. That could mean more debate over tax rates, spending priorities, or the timing of major projects in future budgets.

Because many of the properties involved are apartments and commercial buildings, the effects may be indirect rather than immediate. But county leaders say they are watching closely to ensure that long-term tax stability keeps pace with the region’s rapid growth.

What can be done

Officials said there is little the county can do locally to change the rules governing exemptions, since they are defined by state law and court interpretation. County staff indicated they are sharing data with lawmakers and participating in statewide discussions about potential legislative changes.

Appeals, meanwhile, are a built-in part of the property-tax system and tend to rise or fall with market conditions, meaning the county’s tax base could continue to fluctuate depending on the health of the commercial real-estate market.

A technical issue with real implications

For now, the issue remains largely behind the scenes. But if growth in the tax base continues to slow, residents could see effects such as tighter county budgets, longer project timelines, or debates over how to balance spending with tax rates.

County leaders stressed that the situation is manageable today, but they are closely monitoring how appeals, exemptions, and market conditions evolve in the years ahead.