Governor Stein’s Budget: Putting More Money in Working Families’ Pockets

Proposal aims to widen path with targeted economic relief, investments in essential services, and a balanced fiscal strategy that supports North Carolina’s growing and diversifying population.

Holly Springs, NC, Apr. 3, 2025 — Governor Josh Stein’s 2025–27 Recommended Budget (link) presents a sweeping set of proposals to ease financial pressures on working families across North Carolina. With more than $530 million in targeted annual tax cuts, significant child care investments, and housing assistance, the budget proposes what Stein calls a “commitment to helping families afford housing and access child care, so parents can work as their children learn and are cared for in a safe environment.”

Tax Relief for Working Families

The proposal outlines a package of refundable tax credits. According to the budget, it “provides more than $530 million per year in tax reductions for working families,” including:

A Working Families Tax Credit: “equal to 20% of the federal Earned Income Tax Credit. This credit supports low-to-moderate income workers (those earning up to $68,700) and their families with a credit worth up to $1,600.”

A Child and Dependent Care Tax Credit: “equal to 50% of the federal credit. This credit helps families afford high-quality child care by reimbursing a portion of eligible child and dependent care expenses.”

A Child Tax Credit, which “replaces the child deduction” and is “worth up to $150 per child.” The budget notes this will “increase the existing tax benefit for nearly 700,000 families with children and extend child tax benefits to nearly 200,000 more families.”

A Back-to-School Sales Tax Holiday, providing “state and local sales tax exemptions for clothing and school supplies up to $100 per item, computers up to $750 per item, and computer supplies up to $250 per item.”

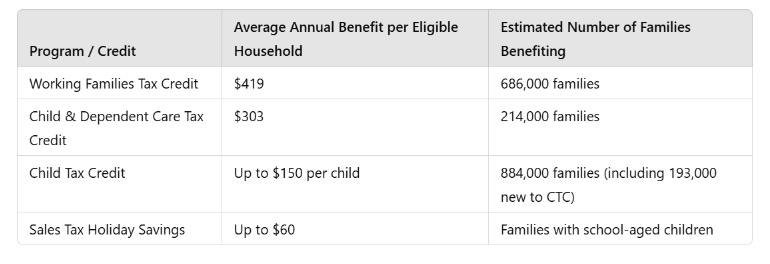

How These Changes Add Up for the Average North Carolina Family

The budget includes a breakdown of estimated average benefits for families taking advantage of the new programs and tax relief:

These amounts are refundable, meaning families receive the full benefit regardless of how much state tax they owe. This makes them especially impactful for lower-income households.

Preserving Revenue for Essential Services

To fund these initiatives, the budget “maintains the current individual income and corporate income tax rates to secure state revenues from sinking below the amount needed to maintain services.” Specifically, it “keeps the individual income tax rate at 4.25%, one of the lowest in the nation, and the corporate income tax rate at 2.25%, the lowest among states that levy this tax.”

These actions are projected to generate “$454.7 million in FY 2025–26” and “$1,968,000,000 in FY 2026–27” in additional revenues. The document notes: “Maintaining income tax rates provides more than $2.4 billion in revenue over the biennium to invest in public schools, make child care more affordable, build our workforce, keep North Carolinians safe, increase access to health care, and help western North Carolina recover from Hurricane Helene.”

In addition, the budget “eliminates tax triggers so that potential future rate reductions can be made in a thoughtful, deliberate, real-time manner rather than on an artificial schedule set out of context with current realities.”

Revenue projections under the proposed changes “show revenue increasing from $34.7 billion in FY 2025-26 to $38.4 billion in FY 2028-29. This ensures that the state can maintain essential services while investing in policies to support working families and promote economic growth.”

Housing and Child Care Investments

The plan allocates “$15 million each year for the Workforce Loan Program to construct or repair affordable housing,” and another “$35 million each year to leverage private sector and federal funds to create more housing for low-income families, veterans, seniors, and people with disabilities.”

On child care, the budget includes “close to $88 million in recurring funds for subsidized care,” and proposes expanding NC Pre-K with “$26.8 million in the first year and $53.5 million in the second year.” It also provides “$10 million each year [for] summer programs for rising kindergarteners.”

Unemployment Benefits Reform

Addressing job loss and economic uncertainty, the budget proposes “bringing unemployment insurance benefits more in-line with national averages.” This includes “increas[ing] the maximum weekly benefit to $470 and adjust[ing] it annually for inflation,” and extending eligibility: “Extends the maximum period of eligibility and ties the duration of benefits to the unemployment rate.”

It also proposes a one-time “credit equal to their employer UI contributions due January 31, 2025” to support businesses.

Broader Impacts

The budget also projects longer-term benefits to child health, education, and family stability. One cited study found that refundable state EITCs “are linked to an 11% reduction in children entering foster care.” Another noted that a $1,000 increase in EITC “increased high school completion by 1.3% and college completion by 4.2%.”