Apex Town Council Reviews Fiscal Year 2026 Budget Options During Work Session

Options include multiple tax scenarios above and below the proposed increase to weigh potential trade-offs. Options ranged from modest cuts to expanded investments, depending on the final rate.

Prior coverage (4/29/25): Apex Budget Projects Average per Household Monthly Cost Increase of $22.74 for Upcoming Year

Holly Springs, NC, May 10, 2025—The Apex Town Council gathered Thursday to assess options for the town’s fiscal year 2026 budget, focusing on how different tax rate scenarios would affect services, staffing, and infrastructure [Meeting Agenda & Documents]. The conversation centered on whether to adopt the town manager’s recommended 2.5-cent property tax increase or consider higher or lower alternatives in light of rising costs and community needs.

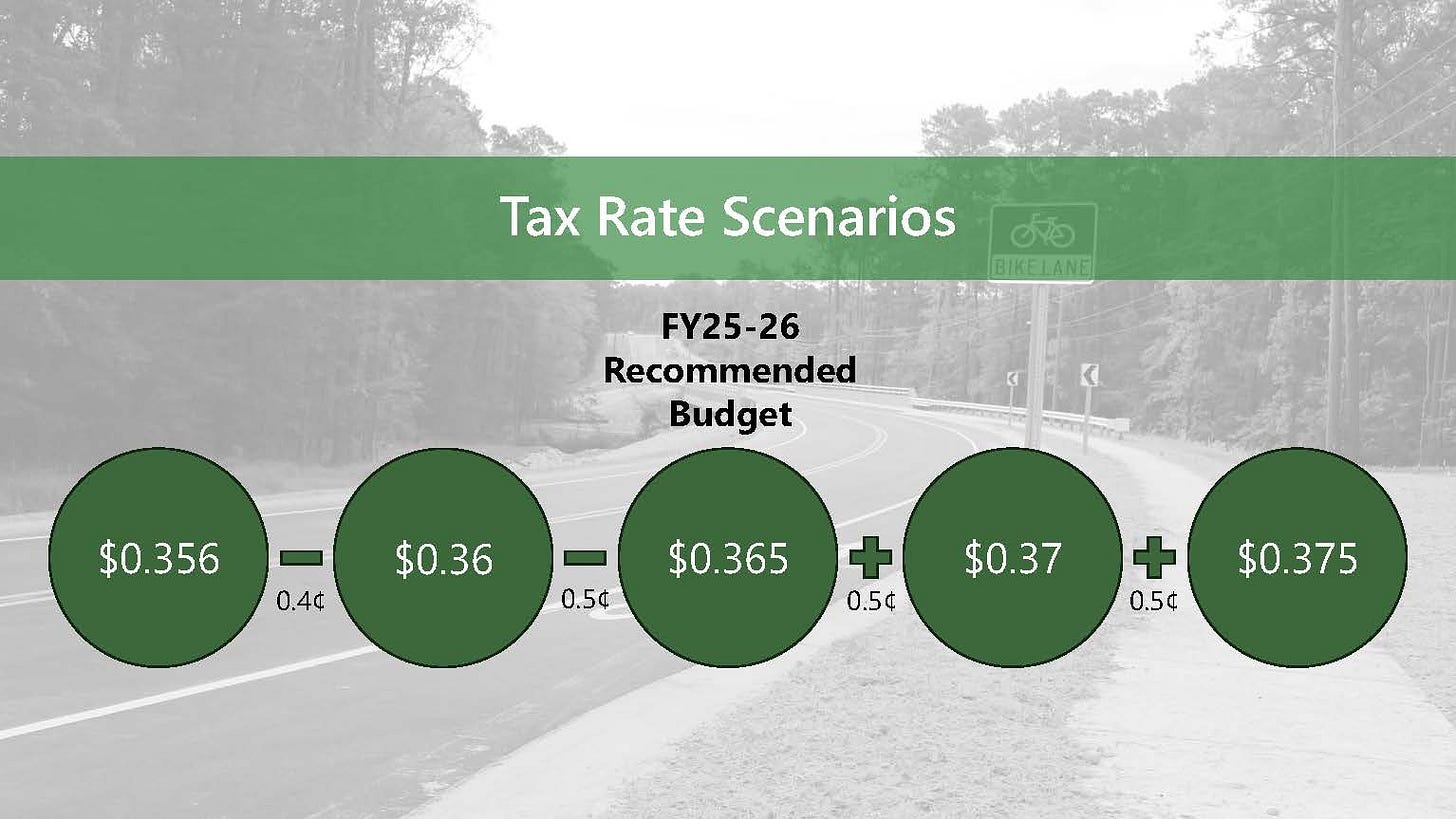

The recommended budget would raise the property tax rate from 34 cents to 36.5 cents per $100 assessed value. This increase is designed to support previously approved transportation bonds, provide dedicated funding for community investments, and add staffing in departments like public safety, parks and recreation, and neighborhood development.

Town staff emphasized that the increase was more modest than in previous years and reflects caution amid slower sales tax growth and economic uncertainty. Nonetheless, council members also noted that Apex’s proposed increase was higher than that of neighboring municipalities, many of which held tax rates steady.

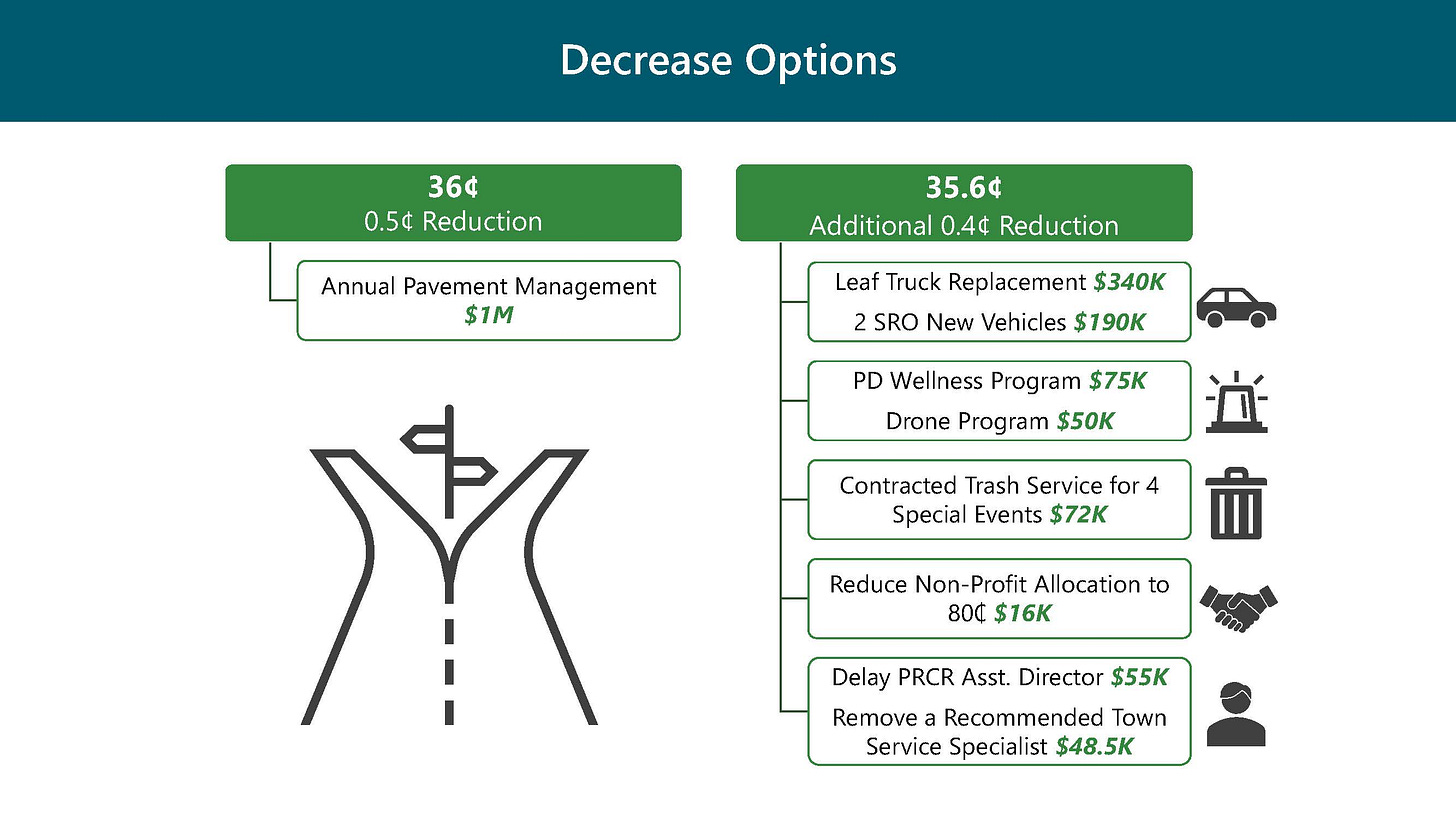

Scenario A: 0.5¢ Reduction – Road Funding Trimmed

One option under consideration would lower the tax rate to 36.0 cents, cutting $1 million from the pavement management program. Town staff indicated that the revised funding would still cover most planned work, particularly on roads in fair to moderate condition. However, the town would lose flexibility to address unexpected road issues, and long-term maintenance costs could rise if current needs go unmet. No other cuts would be required in this scenario.

Scenario B: 0.9¢ Reduction – Additional Cuts Across Departments

The second reduction option would lower the tax rate to 35.6 cents. This option includes all the cuts from Scenario A. In addition to trimming road maintenance funds, this plan would delay hiring for several positions, including an assistant parks director and a town services specialist. It would also reduce funding for a police wellness program and limit investment in the department’s drone initiative.

Other cutbacks include eliminating contracted staffing support for town festivals and reducing the number of vehicles slated for replacement. Nonprofit funding would also be scaled back due to program realignment, and the council’s budget would be reduced by limiting expenses for meals, travel, printing, outreach supplies, and community programming.

This scenario would keep essential services intact but could delay new initiatives, reduce internal support capacity, and strain departments already facing growing workloads.

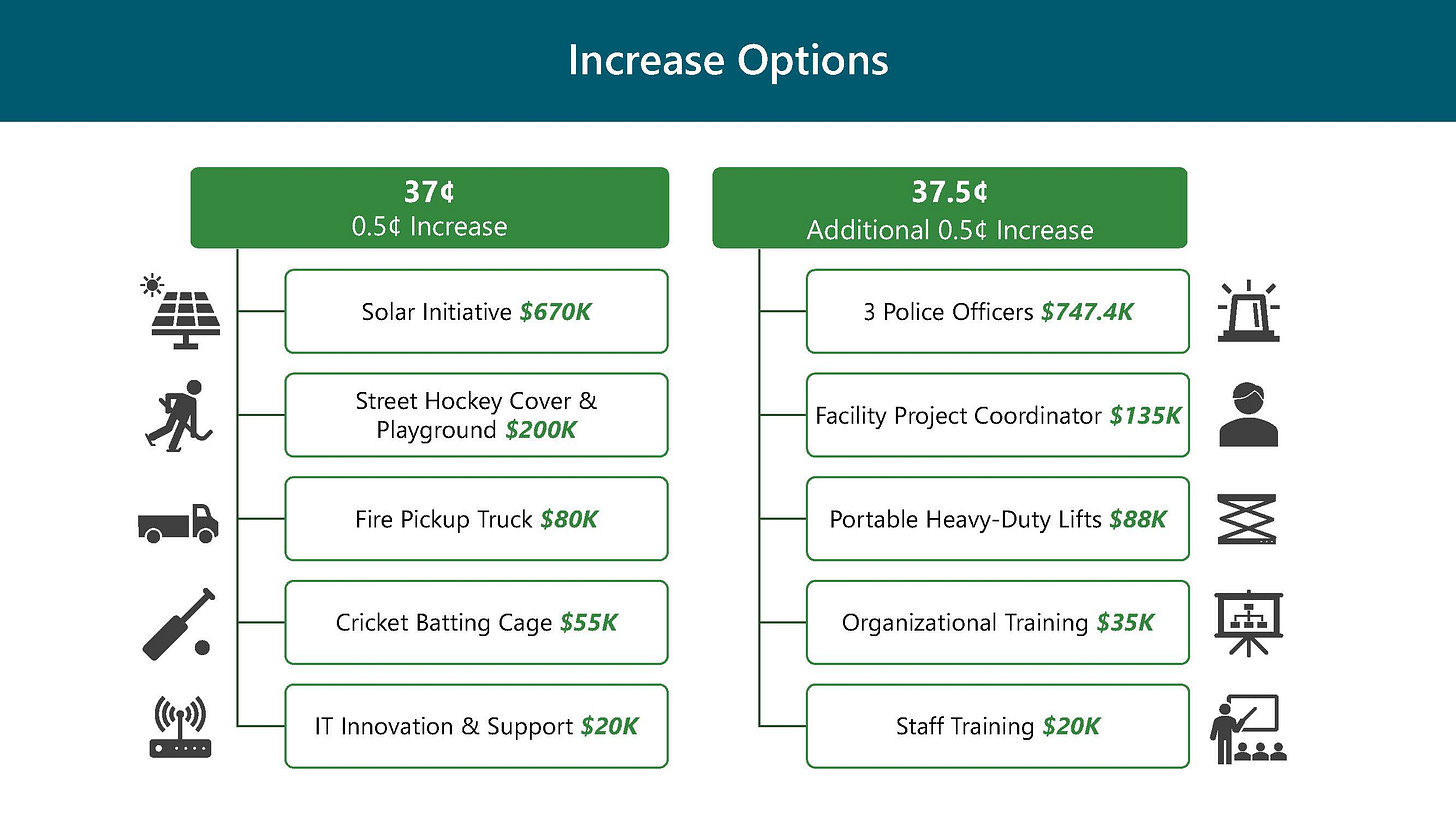

Scenario C: 0.5¢ Increase – Sustainability and Recreation Investments

A third scenario would raise the tax rate to 37.0 cents, allowing the town to restore several items cut during earlier budget planning. These include a solar energy initiative for town facilities, playground and street hockey rink improvements, a replacement pickup truck for the fire department, a cricket batting cage, and small-scale technology and innovation investments.

While the cost of these additions exceeds the expected revenue from a half-cent increase, staff indicated that the gap could be addressed by deploying reserves, phased implementation, or internal budget adjustments. This scenario would allow Apex to reinvest in environmental priorities, expand recreational access, and modernize its service offerings, though it comes with a larger tax increase than initially proposed.

Scenario D: 1.0¢ Increase – Public Safety and Organizational Capacity

The most expansive option would raise the tax rate to 37.5 cents, the highest level discussed during the session. In addition to all items from Scenario C, this plan would add three police officer positions, a facilities project coordinator, a heavy-duty lift for vehicle maintenance, and enhanced training programs for department and organizational staff.

This scenario was presented as a way to keep pace with Apex’s continued growth and strengthen the town’s long-term ability to deliver services. However, it also represents the highest cost to residents and may face resistance.

Next Steps

The council voted to move forward, focusing on the reduction scenarios while keeping the option to adjust specific line items open before final adoption. A public hearing on the budget is scheduled for May 27 at the Apex Town Hall, and depending on the feedback received, the council may adopt the budget that same evening. If additional discussion is needed, a follow-up work session is scheduled for May 29, with final adoption expected no later than June 10.

Prior coverage (4/29/25): Apex Budget Projects Average per Household Monthly Cost Increase of $22.74 for Upcoming Year

Contacts

For more information or to share your thoughts, contact the Mayor or Town Manager:

Mayor Jacques Gilbert

Email: jacques.gilbert@apexnc.org

Town Manager Randy Vosburg

Email: randy.vosburg@apexnc.org